Loan Workouts

We have insider access to the latest deal terms so you won’t leave money on the table

& we have successfully completed more loan workouts than anyone in the industry!

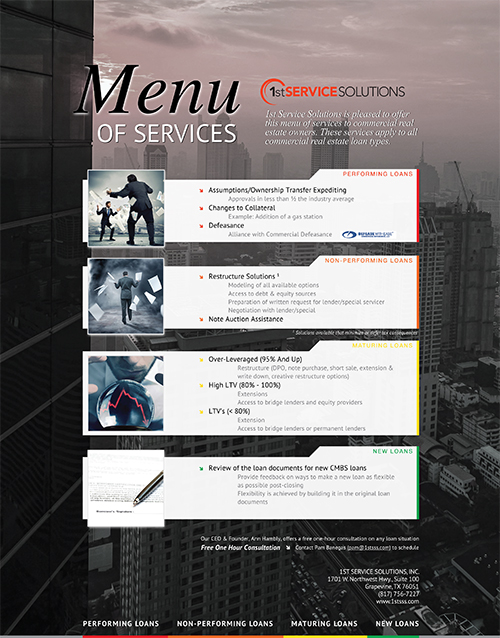

LOAN WORKOUTS / RESTRUCTURES

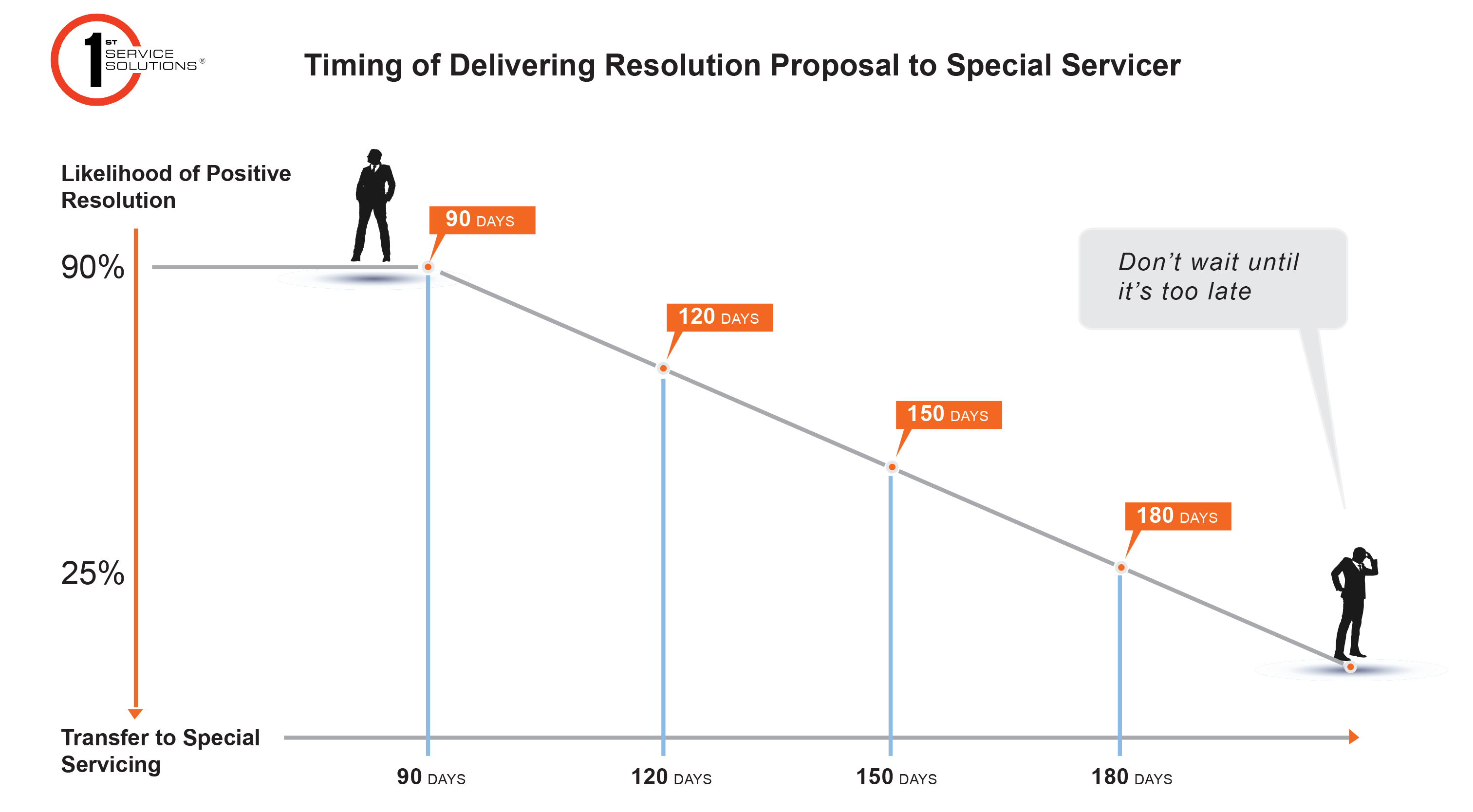

There are many more factors that drive the outcome of a CMBS workout than an owner will likely know or have daily access to. To successfully modify your CMBS loan, you will need to know the following:

- The status of the POOL your loan is in

- How many modifications have been done in the pool and what kinds of modifications have they been

- Which class of bondholders are the losses currently hitting and will your specific modification effect that

- Who the Controlling Class Representative (CCR) is; as they are the ultimate decision maker

- What creative deal terms has this special servicer approved recently

Without knowing these fluid details, it is likely that an owner will not achieve a good outcome and very likely that money will be left on the table.

Modifying a CMBS loan is NOT like modifying a bank loan! Don’t do it alone! You need an experienced advocate on your side. No one else is on the owner’s side!

Value of our Services

INSIGHT & EXPERIENCE

Most borrowers have little understanding of the responsibilities the servicers have. We have both the insight and the experience to help you navigate through the maze of bureaucracy that typifies a loan restructure with a special servicer. What sets 1st Service Solutions apart is that we understand that the restructure of debt is a servicing function. Based on our combined 100+ years of experience in the industry, we can help produce a positive outcome when we negotiate a loan restructure.

Don’t Leave Money On The Table

Our workout team has access to real time deal structures which will be factored into your resolution, thereby maximizing your ROI and results.

We Know How The Game Is Played

Each of our workout specialists have more than 20 years inside the servicing shops. We have been in the very chairs of the people we will be negotiating with.

We Will Get You Results

We have resolved over $18 Billion of CMBS loans since inception in 2005. Due to our results, over 70% of our business comes form repeat customers and referrals.

We’ve Earned Our Star

We achieved the second highest rating by one of the rating agencies for the second year in a row. We are the only CMBS advisory firm who has done this!

We’re The Insider’s Insider

We have relationships with top level decision makers within the servicing shops and we apply our knowledge to help you achieve your goals.

Hear what our clients have to say

Don’t take our word for it, hear what some of our clients have to say about 1st Service Solutions

“I want to express my appreciation to you and your staff of the professional efforts you have provided in working through this challenging assignment. Your organization has followed this workout endeavor through every step, and I have been most impressed with your understanding of the principal issues as well as your negotiating procedures.

Choosing your firm to represent us was definitely the right move for our company, and I am very greatful for your assistance.”

“Ann Hambly knows the CMBS rules, structure and players as well as anyone I know. She has been a part of setting industry guidelines from the very beginning of CMBS. That knowledge is the key to being a successful borrower advocate.”

“The expression of “outperforming expectations” is often overused and misapplied but that’s exactly what 1st Service Solutions accomplished. Ann and her team jumped into a CMBS issue without hesitating and was instrumental in resolving a very impactful issue.”

Workout References

ALLEN MATKINS

Susan E. Graham, Esq.

sgraham@allenmatkins.com

(949) 553-1313

Newmark Merril

Sandy Sigal

ssigal@newmarkmerrill.com

(818) 710-6100

GNL Properties

Rick Gartner

rickgartner@gnlproperties.com

(972) 918-9991