Loan Assumptions - In Record Time

We have successfully completed more assumptions than anyone in the industry!The value of our services on a CMBS assumption:

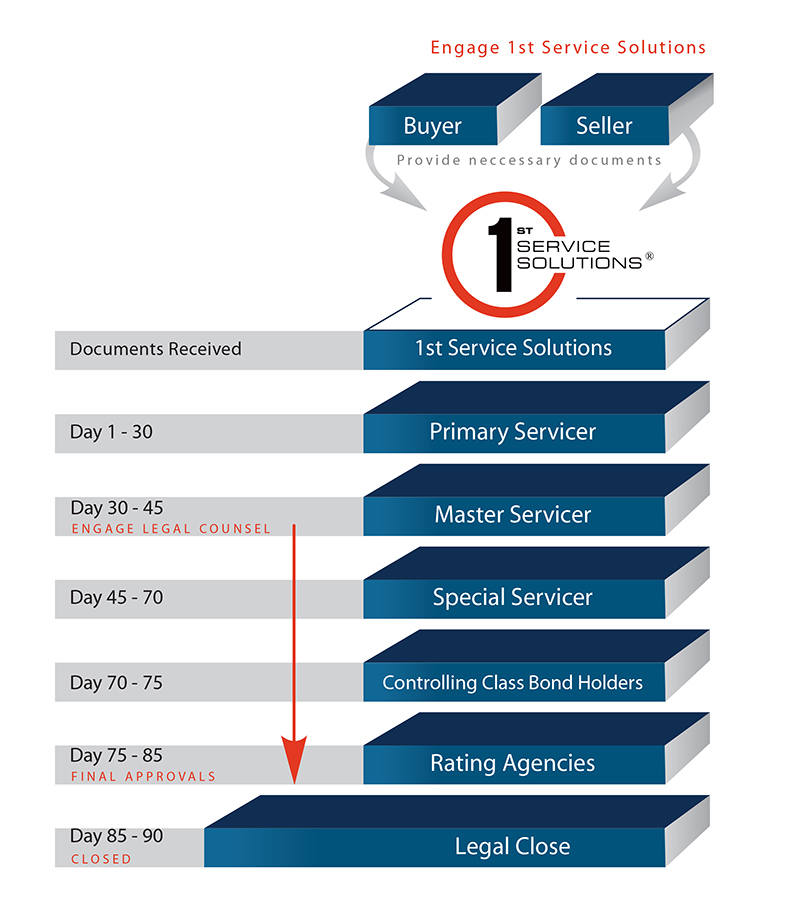

Faster closing

- 60 days for assumption approvals

- 90 all in for closing

- Typically twice this time without us

Higher assurance of closing

- We will ‘pre qualify’ buyers so no one spends unnecessary time and money

- Buyer will understand possible conditions day 1

- Since we will have access to the entire underwriting package for both buyer and seller, we are able to negotiate the conditions with the servicer

- There will be minimal surprises along the way

You will have a GPS

- We serve as the GPS so you always know where the approval process stands (there can be up to 8 approval companies involved in the approval)

- No more black hole

7 Things That Kill A CMBS Assumption

GlobeSt.com Featured Article 7 Things That Kill A CMBS Assumption Ann Hambly, Founder & CEO, 1st Service Solutions 7 March 2017 Flash back to 2003 The Mortgage Bankers Association performed a survey of the industry in 2003 to rate borrower satisfaction with...

1st Service Solutions invented the role of a CMBS advocate/expeditor in 2005

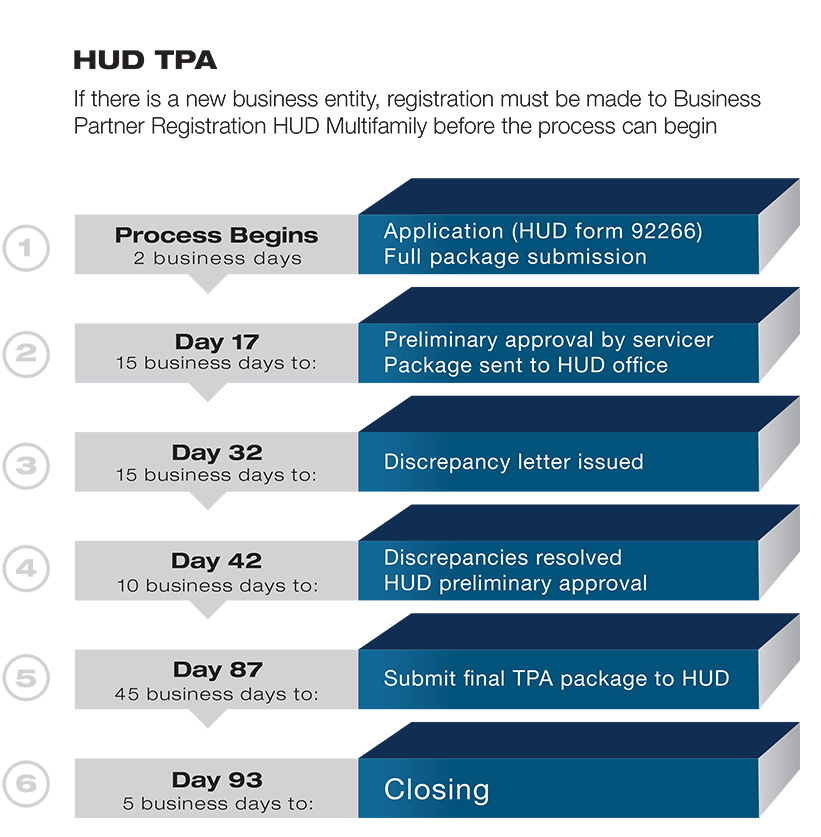

The Process for Assuming any Loan is Complex

However, with the right assistance, a prepared borrower can close on an assumption in a reasonable time frame. 1st Service Solutions expedites commercial real estate loan assumptions of all types by guiding the borrower and seller through each step of the process. From the collection of the required documentation through the underwriting and servicer approval, we will accelerate the approval process by approximately half the industry standard time frame.

With us as your borrower advocate, you’ll have the industry’s 1st and most experienced team at your side.

FREE CONSULTATIONS ARE ALWAYS OFFERED and recommended, as there are many factors that impact the approval process of a CMBS assumption. The process is not standard and has nothing to do with whether a buyer can qualify for a new loan or not!

Our fees are highly competitive and are typically split between buyer and seller.