Loan Assumptions

We have successfully closed thousands of CMBS, Fannie and Freddie loan assumptions.

CRE ASSUMPTIONS AND CHANGE IN OWNERSHIP

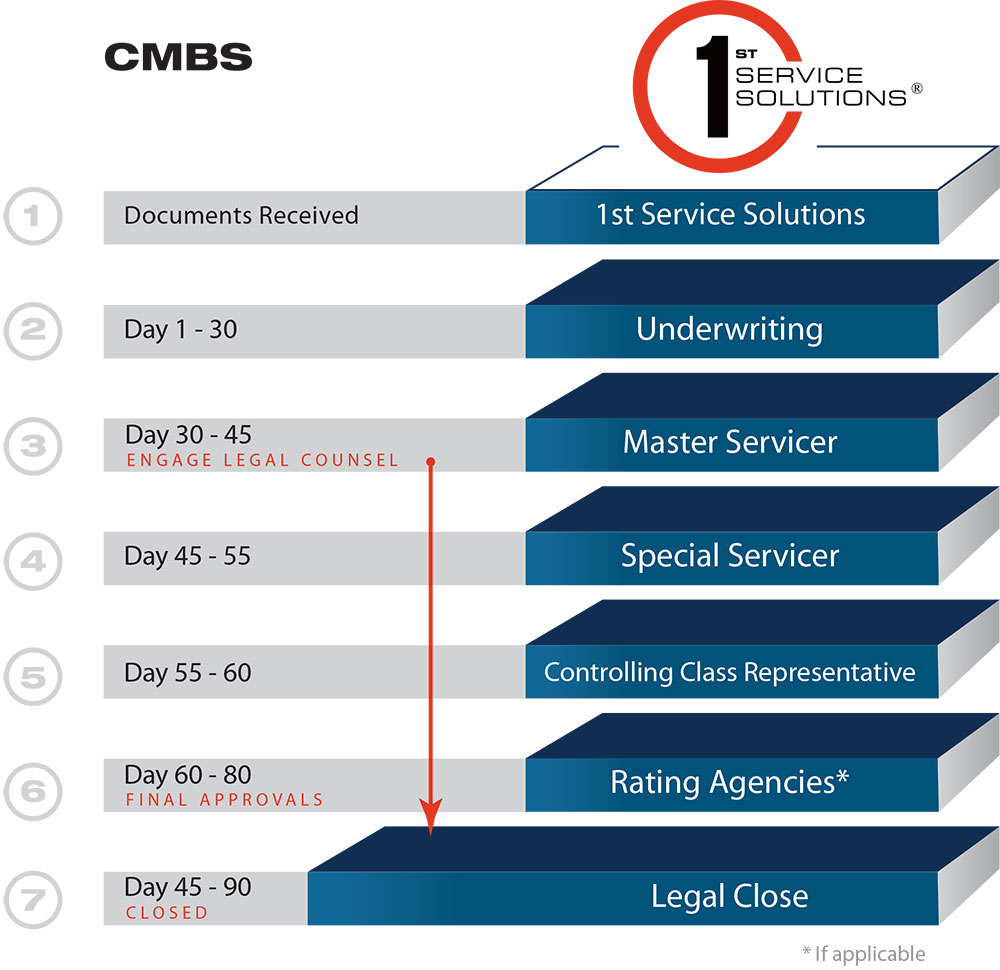

1st Service Solutions is the 1st and most experienced Borrower Advocate in the industry! We have successfully closed thousands of CMBS, Fannie and Freddie loan assumptions. If you or your client will be buying or selling a property with an assumable loan in place, 1st Service Solutions will help you close in record time! Most importantly these days, we also prepare you for possible conditions which may accompany approvals and negotiate the conditions so you end up with the best possible outcome.

The assumption approval process has little to do with the proposed borrower’s qualifications to get a new loan and has much to do with the strength and background of the borrower in place. The underwriting is based on a comparison of the buyer (or proposed borrower) and the seller (or current borrower). With a business person who understands the underwriting on your side, the transaction will have the highest likelihood of not only closing, but closing quickly.

3 Types of COVID Relief

The 3 Types of COVID relief for CMBS BorrowersOctober, 2020 by: Ann Hambly Blogs News SuccessesThese are just guidelines. There are no standard packages being offered and all require extensive and time consuming negotiations. Your CMBS advisor will share with you the...

Value of our Services

There is no assumption project too large or complex for us. The same team that has helped the top 25 CRE owners obtain approval to transfer ownership is available to help you succeed too.

Faster Closing

Assurance

'Pre-Qualify'

Conditions

GPS

YOU HAVE OPTIONS

STARTER PACKAGE

*Plus Hourly fee for anything not included below

- Buyer Consultation/Vetting

- Collect, review and analyze documents

- Provide feedback on possible conditions

- Submit assumption package to servicer

- Coordinate all parties through underwriting, approvals process & legal documentation

- Facilitate servicer questions

- Negotiate conditions of consent with servicer

- Provide consistent updates to buyer & seller parties

FULL PACKAGE

*Everything from consultation to closing the deal

- Buyer Consultation/Vetting

- Collect, review and analyze documents

- Provide feedback on possible conditions

- Submit assumption package to servicer

- Coordinate all parties through underwriting, approvals process & legal documentation

- Facilitate servicer questions

- Negotiate conditions of consent with servicer

- Provide consistent updates to buyer & seller parties

YOU HAVE OPTIONS

*Hourly fee applies for anything not included

DIY PACKAGE

FULL PACKAGE

Coordinate all parties

Underwriting, approvals process & legal documentation

Provide consistent updates to buyer & seller parties

What Our Clients Have to Say

“A huge thank you to 1st Service for your efforts and specifically, to Stephanie for helping to keep this on track and setting us up to close a time sensitive deal both “smoothly” and on time! Sometimes a deal seems to go much smoother than it really has because of the “behind the scenes” work being done by Stephanie and the rest of your team. Please know that those efforts are appreciated, recognized and acknowledged. I am confident this deal would not have gone nearly as smoothly and most likely would not have closed on time without the expertise and relationships of 1st Service behind it. We will certainly seek the benefit of your services again in the future should we find ourselves dealing with CMBS or similar type lender”

“Our $1.2Billion transaction would not have closed without 1st Service Solutions.”

“I can’t thank you enough for your assistance on our assumption. Quite frankly, I don’t think we could have made it without your help. Your firm adds a tremendous value when dealing with the CMBS monster.”

“It was awesome working with you guys and I couldn’t imagine this process going as well as it did.”